Data Center urged 100G optical devices reduce costs

9/18/15 | Industry NewsOptical communication technology in the 2015 forum held recently, Ovum analyst Daryl Inniss speech, analyze the optical communication opportunities in the data center field. He said the data center network is driving demand for high-bandwidth connections between data centers and data center for internal. Terabit-level connection between the data center needs; and internal data centers require more cost connection to 100G. However, the high cost of optical networks market slowdown in the rate of expansion is a fundamental problem.

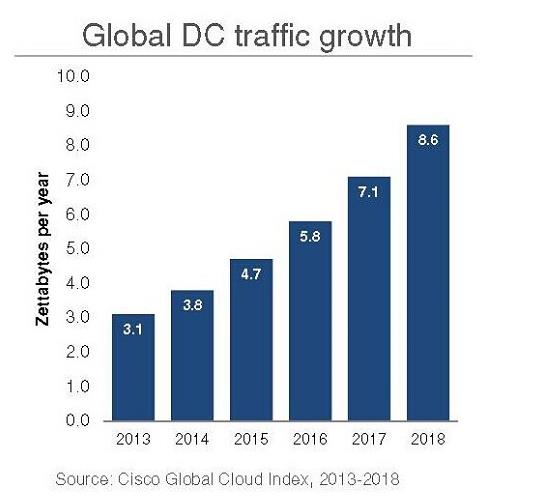

According to Cisco's forecast, 2013 ~ 2018 global data center traffic will nearly double, which promote the data center interconnect (DCI) requirements. Service providers are faced with increasing pressure, they need to reduce costs, improve service rates, and provide higher bandwidth services. In this one, Internet content provider (ICP) is the largest promoter of the data center and connectivity requirements.

However, Ovum's analysis pointed out that expensive 100G optical network transceiver costs has become a fundamental development issue. The market is expected to improve the data transfer rate 10 times, then the cost will increase by 4 times. The current analysis shows 100G costs are still too high. However, this problem is also an opportunity for new market entrants and new material systems.

Daryl Inniss expressed, ICP is promoting new opportunities for internal DCI, these Internet content providers are changing communications market dynamics. They have been in the design and build its own facilities, and direct purchase transceiver.

As of July this year, the C114 has reported an Ovum report "Data center interconnect market in 2014 increased by 16%, equipment manufacturers need to meet new challenges," noted the same, ICP want to use and deploy rack assembly equipment wherever possible and it has been in the design and build its own server (they are already designing their own components), its own switch, but they also use white card switches and servers, but also the first to introduce the SDN. In addition, ICP through direct purchase transceivers to control costs and supply, they believe that the existing transceiver is over-designed.

ICP is promoting SDN, open systems and the development of white card component vendors. According to Ovum's forecast, and now the white card manufacturers accounted for only less than 10% of the Ethernet switch market share by 2018 this figure will increase to about 30%.

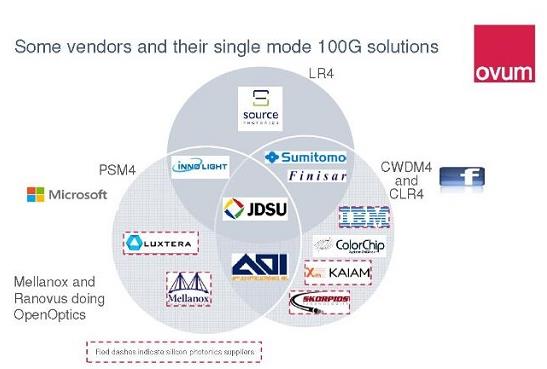

"100G optical network is the biggest problem." Daryl Inniss said that the network data center prefer singlemode 100G solution, because compared to the multi-mode fiber can support longer distances and higher bandwidth. IEEE standard is 10 kilometers, but the link length is longer than the demand, so the price is too high. Multiple multi-source specification protocol has been used to support 500m ~2000m link, including PSM4, CWDM4, CLR4, LR4-lite and Open Optics etc., but only CWDM4 and CLR4 are interoperable, does not have an internal optical network Interoperability will lead to a fragmentation of supply. Ovum believes, CWDM4 likely to become long-term solution would be a single-mode, high-capacity solution.

For example, he said, Facebook requires cost per Gbps in 1 dollars, but the price per Gbps currently has more than 20 US dollars.

At the same time, ICP also pushing new Inter DCI Opportunities (connection between data centers). Software separate from the hardware out: large Internet content providers are also experts in the field of software, they insisted that he compared to the equipment manufacturers are more adept at writing software. Meanwhile, equipment manufacturers are working to create a dedicated data center interconnect equipment for ICP them.

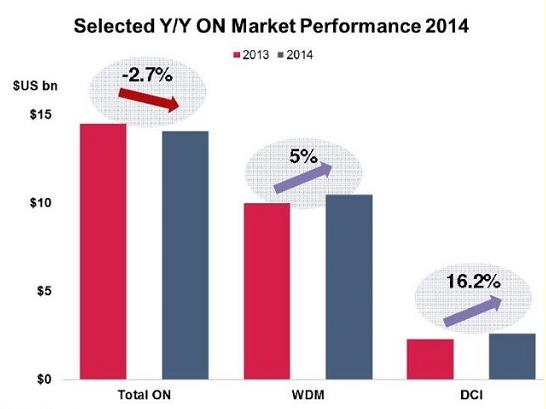

"DCI is a high-growth segments, and for optical network vendors increase revenue and differentiation is a key opportunity." Daryl Inniss representation. According to Ovum's data, the overall optical network market in 2014 fell by 2.7%, but WDM grew 5%, DCI is an increase of 16.2%. Market are turning to 100G and Ultra 100G. Inter DCI equipment demand is at 100G respects, this shift in North America was the most rapid development.

Daryl Inniss said silicon photonics is the internal and external DCI problem is most likely solution, but large enough volume market is the next obstacle to achieve low-cost silicon photonics.

data center, 100G, optical network, transceiver, DCI, ICP, interconnect equipment

data center, 100G, optical network, transceiver, DCI, ICP, interconnect equipment